There's Too Much Inventory: A Signal From Jabil

Many industries are still working hard to normalize inventory across the supply chain.

Economists love to discuss and debate predictions around the business cycle. Are we expanding or contracting? Will unemployment increase? When will a recession start? When will growth increase? The debates and predictions never end, nor should they. We will never see a sign that says “We are at THIS point in the business cycle”. With so much data and so many conflicting signals — there’s no perfect way to measure or analyze the economy, which leaves us all making educated guesses as time moves on.

The supply chain bullwhip is a similar never-ending cycle of expansion and contraction. And much like the economy, industry analysts like to ‘read the tea leaves’ and try to predict when the cycle turns. They try to call tops and bottoms in prices and inventories.

Supply chains, while chaotic, are less complex than the macro economy and can send out strong signals about their cycles. The signals aren’t perfect, but can still help paint a picture illustrating the balance of supply and demand. For example, the everything shortage spurred by the pandemic ultimately reversed into an abundantly clear freight recession in 2023. There was too much freight supply to move too few products as demand shifted from goods to services and downstream distributors and retailers looked to reduce inventory.

Earlier this week, Jabil, a contract manufacturer, lowered its guidance for the next 2 quarters, decreasing revenue forecasts to project declines of 13.3% and 10.3% year-over-year. Jabil stock dropped 11%.

“During the final stretch of our first quarter, we experienced softening in demand, as a result of short-term inventory corrections across certain end-markets where we participate,” - Kenny Wilson, Jabil CEO

The commentary from Jabil signals that the supply chain bullwhip is hitting them hard. The company had already projected a decrease in their sales for the year and now has to cut forecasts even further. Wilson’s commentary shows us that the inventory corrections we saw earlier this year are not done yet and have more room to run. Lets pull back the curtain on Jabil’s supply chain to see what else we can learn.

What Does Jabil Do?

Jabil is a manufacturing services company. It provides electronics design, manufacturing, and product management services to companies that do not want to have a significant physical manufacturing presence of their own. In layman’s terms, Jabil is a manufacturing partner for companies that focus on designing products instead of physically making them. (Apple doesn’t own factories, it designs its products and outsources the manufacturing to a company like Jabil).

As one of the largest EMS companies, Jabil’s business spreads across multiple industries and end-markets. From driver-assistance cameras, to EV chargers, optical transceivers, 5G networking equipment, semiconductor wafer handlers, solar inverters, and even iPhone and AirPod components, Jabil’s reach is far and wide.

Jabil’s cross-industry presence make the company a must-watch for understanding the health of the global supply chain. On the heels of its latest announcement, we can look through to some of Jabil’s customers and to get a better understanding of what is happening with inventories.

Telecom & Networking Inventory Indigestion

The communications and networking end-market has consistently been Jabil’s largest. It doesn’t take very long to see the inventory challenges facing companies across the industry.

Earlier this month, Cisco saw its stock drop 10% in response to a weak forecast as its customers are ‘digesting’ from high levels of inventory. Nokia and Ericsson are seeing sales of their 5G equipment slow as North American customers are working through extra inventory. The Wireless LAN market is experiencing a similar slowdown in sales.

Commscope, another one of Jabil’s customers, saw its stock drop 39% in a single day on October 30. Once again, we see evidence of the inventory build in Commscope’s results.

“we also saw demand weaken in our ANS business where customers are managing higher than required inventory levels and experiencing project delays in some of their upgrade plans. We believe this softer demand environment will continue as we move into the first half of 2024, impacting both revenue and profitability.” - Chuck Treadway, President and CEO of CommScope

Its clear that the customers of Jabil’s networking customers are working through excess inventory. But its not just the customers of Cisco and others with too much inventory. Jabil’s direct customers have too much inventory on their hands.

Cisco’s inventory to sales ratio has been above 0.30 for 5 consecutive quarters. Prior to 2022, the ratio was never above 0.151. Cisco still has a long way to go before getting its inventory levels back to normal. Even if the new normal was 0.20, that would imply Cisco’s current inventory levels would need to fall by about 30% (decrease by $1.3 billion) to reach such a level.

Too much inventory isn’t a problem specific to Cisco either. Arista Networks, Calix, and the aforementioned CommScope all use Jabil’s manufacturing services and also have inventory/sales ratios well above their historical norms.

We can easily see telecom and networking equipment companies have too much supply. Now lets turn to some other end-markets.

An Oversupplied Solar Supply Chain

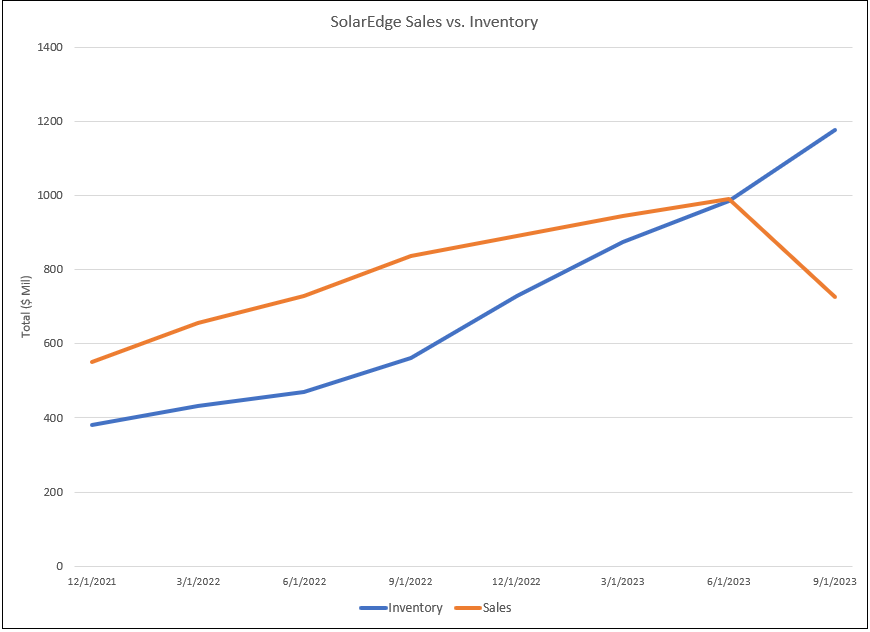

The current supply buildup in the solar supply chain is hard to miss. The bullwhip came faster than many companies were expecting and inventories are very bloated. SolarEdge, one of the largest publicly traded US solar companies, is also one of Jabil’s largest customers.

SolarEdge was grew revenue by over 50% in 2022 and was buying up extra inventory to help fuel future growth. The bullwhip came hard for SolarEdge. The growth didn’t come, but the inventory did. In Q3 2023, sales dropped 27% and inventories grew 20%.

In response to the inventory buildup SolarEdge discontinued its manufacturing in Mexico and reduced its capacity in China.2

Badri Kothandaraman, the CEO of Enphase Energy, who relies on Jabil’s competitor Flex for manufacturing, had some pretty telling insights on the current supply and demand imbalance facing solar:

“we are undershipping to the end market demand for our products by approximately $150 million. We anticipate undershipment will continue in Q1 and expect our channel inventory to normalize in Q2. Of course, we are conservative and assuming the demand picture is unchanged from the current level.

So what has changed since 90 days ago when we told you that the inventory levels would normalize by the end of Q3? We have seen a substantial demand reduction in Europe. We've also seen the U.S. market continue to fall, driven by California. When the demand falls, we think more decisive inventory correction becomes necessary.” - Badri Kothandaraman, Enphase Energy CEO

Solar supply and demand are so misaligned that Enphase has to restrict the product it ships downstream. This of course will lead to a bigger inventory level on Enphase’s books. And that excess inventory doesn’t magically go away. It must work its way through the supply chain at a later date or get written off the books. Enphase’s stock dropped 15% the day following their latest earnings release & update on inventory.

The solar industry, just like the communication and networking industries, is sitting on too much inventory. On to the rest of the supply chain we go.

Jabil’s Other End-Markets & Upstream Suppliers

We can rapid fire through a handful of other Jabil customers, end-markets, and upstream suppliers to see the same inventory build problems ringing true.

Deere : Built up too much inventory in South America and will be pulling back production in 2024. Dealer inventories are also overstocked which will hurt 2024 demand.

Zebra Technologies: Focused on right-sizing inventory as demand cools and their distributors work down inventory levels.

ScanSource: One of Zebra’s top distributors, echoed Zebra’s sentiment and is working “supplier by supplier to course correct our inventory positions”.

Electric Vehicles: EV dealers recently wrote a letter to the president highlighting theie growing inventories and difficulty selling EVs, saying: “electric vehicle demand today is not keeping up with the large influx of BEVs arriving at our dealerships prompted by the current regulations. BEVs are stacking up on our lots.”

TTM Technologies (circuit board supplier): Reported declining sales in multiple end markets due to inventory digestion, reduction, and adjustments at their customers.

Avnet (semiconductor distributor): Discussed how many of their supply chain partners believe inventory levels for certain parts in the supply chain are elevated and need to come down. Avnet expects the inventory drawdown to take multiple quarters.

The picture is clear, no matter where you look. There’s too much inventory.

What Happens Next?

Its time for a little prediction here. I’m not bold enough to pick a day and say ‘this is when the inventory problems will be over’. But I do think there’s enough data to support my prediction that this downturn in demand and inventory digestion period will last longer than expected.

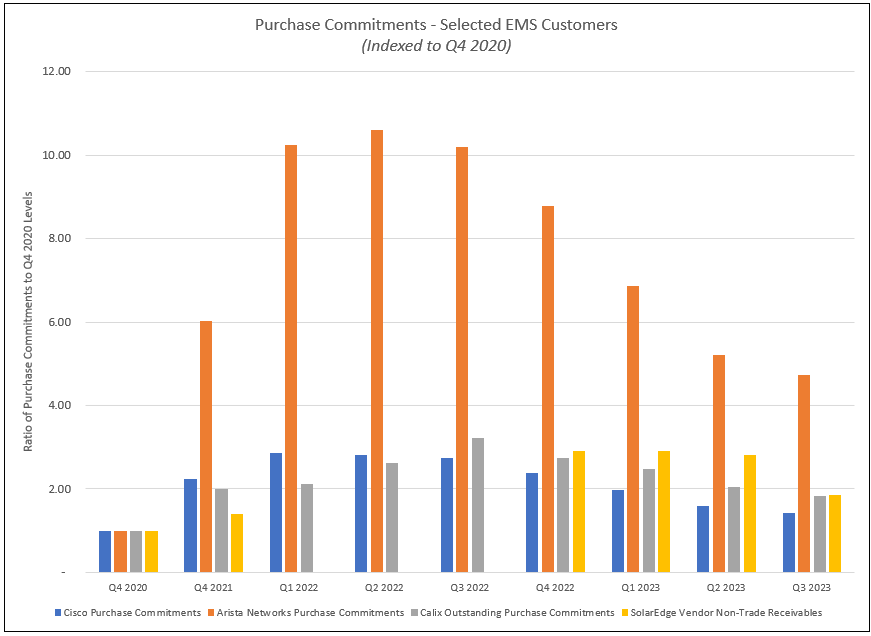

Why do I think a prolonged inventory downturn is likely? Purchase commitments. Promises made by customers to their suppliers that they will buy their products. Inventory levels are elevated, and while customers want to reduce their own inventory and supply, the purchase commitments limit how quickly and how fast they can do so.

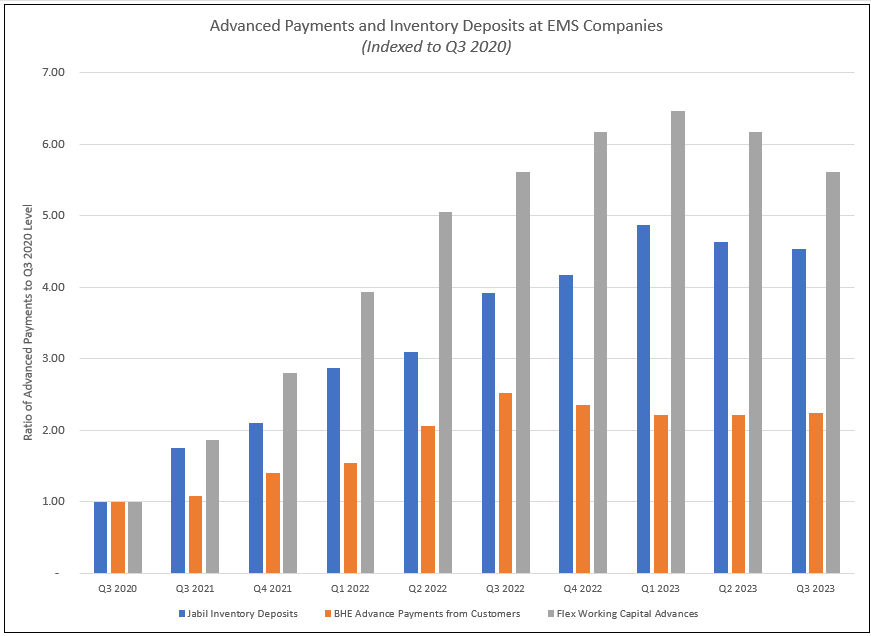

Our first chart shows advance payments and inventory deposits at Jabil and some of its EMS peers. We can see that compared to 2020 levels, there’s a lot of advanced payments and promises sitting on their books. Jabil has over 4 times more inventory deposits than it did in 2020, Flex has over 5 times more inventory deposits.3

On the other side, we can look at purchase commitments for a handful of Jabil’s customers and see the same picture. Arista destroys the chart, but we can still see that purchase commitments in Q3 2023 are at least 50% higher than they were in 2020.

Companies rushed to secure supply when it was short, now they have to honor their commitments to their suppliers, taking inventory when they don’t want it. This is the bullwhip flowing up the supply chain. And it will lead to a longer correction cycle for inventories.

I expect to see more downward revisions from Jabil’s peers and upstream suppliers in the coming months as the bullwhip continues its way up the supply chain. If you have favorite industries or stocks you follow, now is the time to look downstream at the customers to understand their purchasing and inventory plans.

And where are we in the cycle? My best guess, which isn’t very bold, is the middle. We can already see inventory levels have come down from the highs. But they still have a long way to go across the board. If you want an inning, we are in the bottom of the fourth.

I am including Cisco’s inventory deposits and prepayments to their total inventory. Both represent the capital used to acquire inventory.

SolarEdge is also ramping production within the US, which is likely going to replace the Mexico capabity. The reduced China capacity probably speaks more towards reduced european demand. US tariffs on the solar industry make it unlikely for Chinese-manufactured products to be US-bound.

This is indexed to Q3 2020 because the companies have varying levels of payments. In Q3 2020, Benchmark, Flex, and Jabil had $58.6M, $356.1M, and $405M in inventory deposits and advance payments. In Q3 2023, those numbers were at $189.1M, $2,000M, and $1,839M respectively.